“We won’t see a singular moment where AI ‘takes over.’ It’s already happening—gradually, silently—and by the time we realize it, it’ll be everywhere.”

— Johnny Mejias, Head of Engineering at Payabli

The Invisible Transformation

While headlines debate whether AI will revolutionize finance, SaaS platforms are already experiencing the quiet reality: it already has. Every time your users receive payment suggestions during onboarding, invisible AI is working in the background. This includes blocking fraud attempts and automatically handling overnight reconciliation. It protects your platform’s reputation and lowers your support burden.

The most profound technological shifts don’t announce themselves loudly. They embed themselves so seamlessly into your platform that you only notice their absence. In embedded payments, this invisible transformation is reshaping how SaaS platforms monetize and serve their customers in ways that drive both revenue and retention.

Common Misconceptions About AI in Fintech

AI is transforming embedded payments, but the conversation is often clouded by myths and misunderstandings. Let’s break down the most common misconceptions and explore the real potential of AI in payments:

Misconception #1: AI in embedded payments is just about chatbots and customer-facing features.

“People often frame AI in payments only through the lens of payers and merchants. But the bigger opportunity is how it protects and optimizes the relationship between businesses themselves.” — Johnny Mejias, Head of Engineering at Payabli

The reality is far more sophisticated. Customer-facing AI gets a lot of attention. However, the real change happens at the platform level. Here, invisible AI improves your operational intelligence, strengthens compliance monitoring, and optimizes resource use.

Consider how AI enables your payment infrastructure to automatically detect unusual transaction volume spikes across your merchant base, predict which integrations might fail based on historical patterns, and dynamically allocate processing resources before your users experience bottlenecks.

Instead of hiring additional analysts to monitor thousands of transactions manually, AI systems can flag anomalies, prioritize support tickets by urgency, and even suggest resolution paths. This changes your support model from reacting to problems to improving the platform before issues arise.

Misconception #2: AI must be visible to be valuable.

“AI is quietly reshaping payments behind the scenes—automating risk checks, streamlining onboarding, and reducing fraud—all without anyone needing to click a button.” — Reilly Catrambone, Software Engineer at Payabli

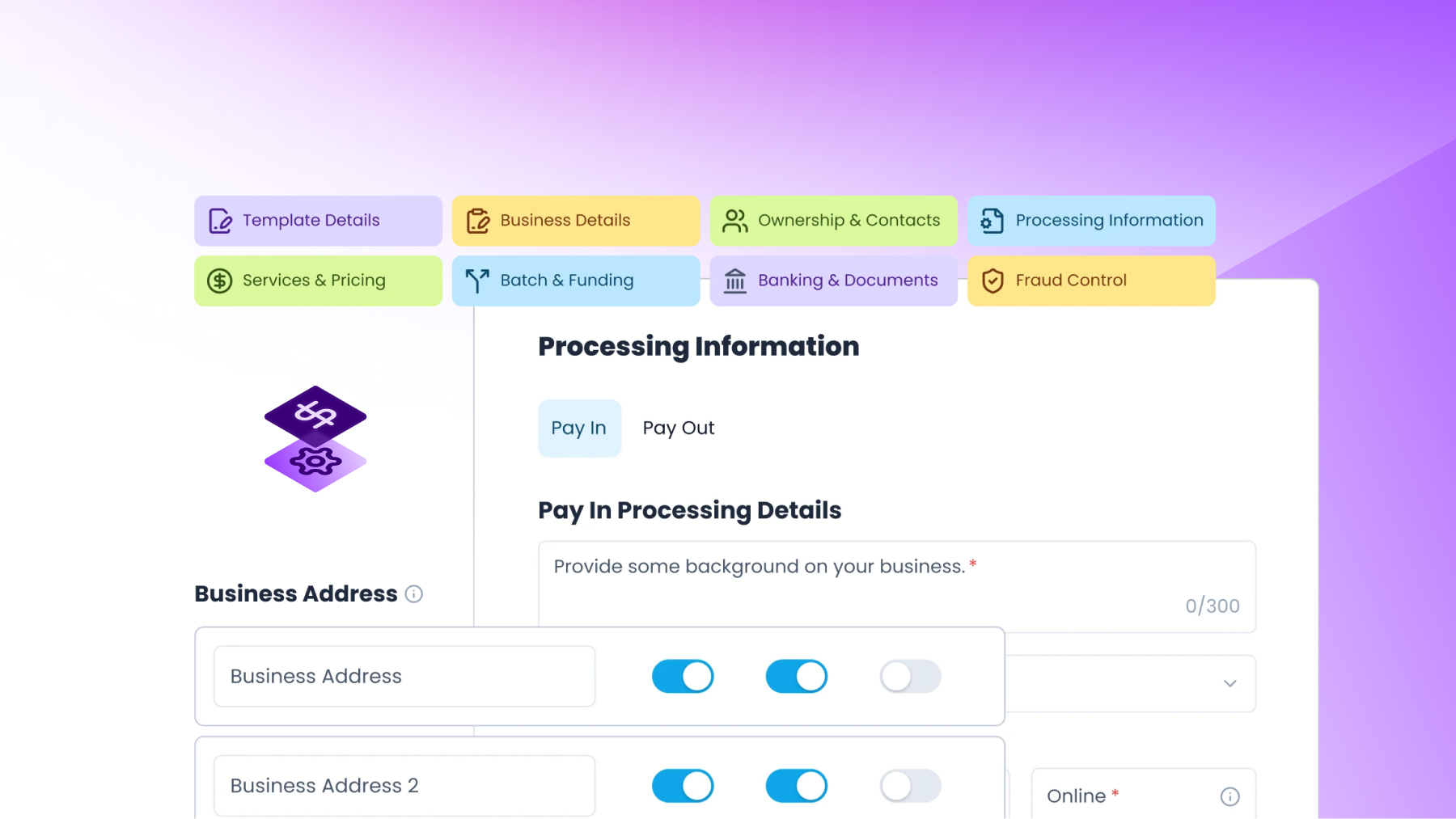

The most effective AI implementations in payments are the ones your users never interact with directly. Consider address auto-completion during merchant onboarding. When your users start typing “123 Main St” and your platform instantly suggests the full address with zip code – that’s AI working invisibly.

Your merchants experience faster onboarding and reduced friction, but the machine learning models powering that suggestion engine remain completely hidden, seamlessly integrated into your existing UX.

At Payabli, we take the same approach internally. Tools like Amigo, our chat-based AI assistant, work behind the scenes to help our internal teams gather insights, simplify workflows, and speed up response times. This layer of invisible AI is made to help humans, not replace them. It shows that some of the best innovations are the ones you cannot see.

Misconception #3: All AI payment solutions are created equal.

“Our advantage is in the depth of our data. We don’t just have transaction volume—we understand vertical nuance. That’s what lets our models make smarter, context-aware decisions.” — Alex Finan, AI Engineer at Payabli

Many SaaS platforms think that AI features are the same. They believe one machine learning model is just as good as another. The reality is that AI is only as intelligent as the data it learns from and not all payment providers have the same quality of training data.

While the broader payments industry races to implement AI features, at Payabli we focus on depth over breadth to leverage unique data advantages to build more intelligent, context-aware systems that understand your specific vertical needs.

This vertical-specific intelligence means our AI doesn’t just process your transactions – it understands the business context behind them. Where generic payment processors see transaction volume, we see the relationships, workflows, and patterns unique to your industry, enabling more accurate risk assessment and better user experiences for your specific customer base.

The Vertical Intelligence Advantage

While many providers rely on one-size-fits-all AI models, the real impact comes from context-aware intelligence tuned to the realities of each vertical. SaaS platforms don’t operate in generic payment flows. What looks normal in field services might appear risky in healthcare, and vice versa.

Real-World Applications Across Verticals:

- Healthcare SaaS: Detect subtle anomalies in patient billing cycles, reduce false declines on recurring reimbursements, and enforce compliance checks without friction.

- Field Services SaaS: Predict seasonal payment spikes, optimize mobile transactions, and prevent fraud tied to technician misuse.

- Education Platforms: Align AI to academic calendars for recurring tuition payments, minimizing payment failures and reducing disputes.

- HOA & Property Management: Forecast cash flow gaps, identify at-risk homeowners before they miss payments, and trigger proactive reminders to maintain financial stability.

Platforms that pair data depth with vertical nuance will lead the way in embedded payments. At Payabli, this focus shapes how we apply AI to fraud prevention, reconciliation, and revenue optimization – helping platforms deliver smarter, more resilient payment experiences.

What’s Next: AI Capabilities That Will Redefine Embedded Payments

Looking ahead, several AI capabilities are poised to fundamentally reshape how embedded payments work:

1. Automated Operations and Reconciliation

“AI is going to change the game when it comes to reconciling payments with bank flows. We’re talking about full automation of operations that used to require the work of entire teams.” — Johnny Mejias, Head of Engineering at Payabli

Traditional reconciliation requires manual review of transaction records against bank statements—a process prone to delays and errors. AI-powered systems can automatically match payments, identify discrepancies, and resolve most issues without human intervention. This isn’t just about efficiency; it’s about enabling real-time financial accuracy at scale.

2. Intelligent Risk Management & Fraud Agents

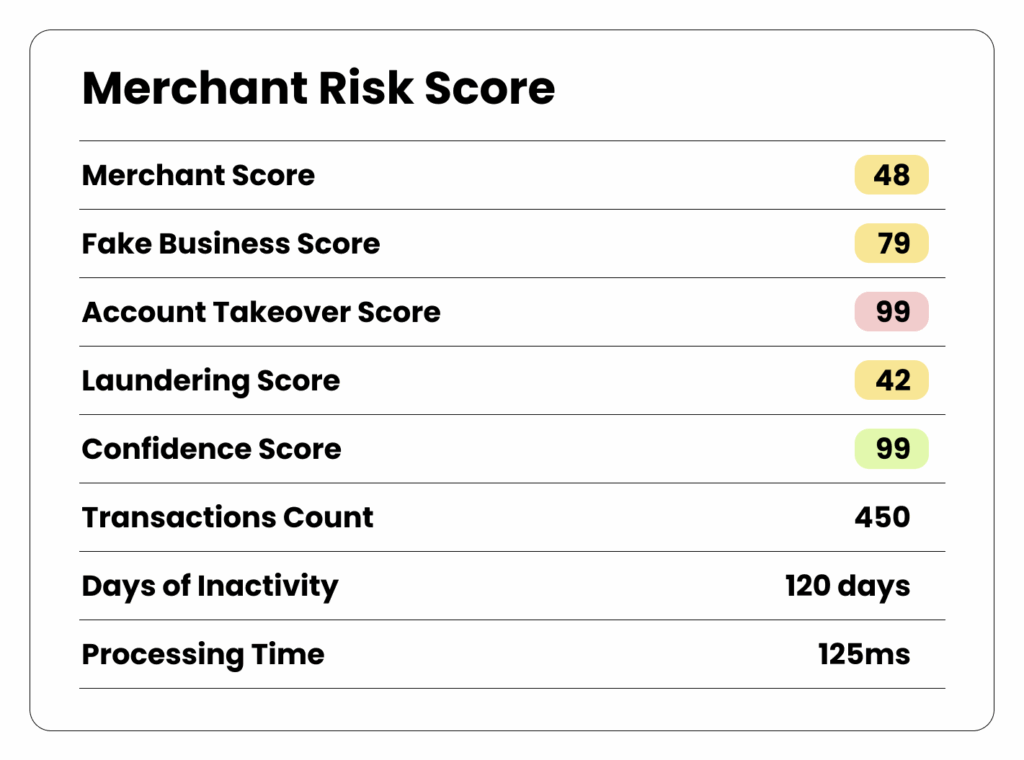

The next evolution in AI fraud detection goes beyond pattern recognition to proactive risk orchestration. AI agents will analyze transaction characteristics, merchant behavior, and external signals to make risk decisions in milliseconds. Whereas today, these decisions need skilled analysts and hours of work. By analyzing millions of transactions, these systems learn what “normal” looks like across different verticals, enabling instant response to anomalies.

At Payabli, we’re already implementing this vision through our advanced Fraud Risk Engine, which combines rule-based controls with machine learning models for both supervised fraud detection and unsupervised anomaly detection. The system automatically enforces dynamic transaction limits, velocity checks, and risk parameters while learning from each interaction to improve accuracy.

What makes this powerful for SaaS platforms is the ability to customize AI fraud detection. This can be done for each partner or industry. It ensures that your platform’s unique risks are understood and protected without causing problems for real transactions.

3. Self-Service User Empowerment

“In five years, embedded payments won’t just be about moving money. It’ll be about giving merchants self-serve tools powered by AI to grow on their own.”

— Ankita Chowdhry, AI Product Lead at Payabli

The future of embedded payments extends beyond transaction processing to business intelligence and growth enablement for SaaS platforms. AI will provide your platform with insights about payment patterns across your user base, optimization recommendations for improving conversion rates, and automated tools that help both you and your merchants improve cash flow and customer experience without additional development resources.

Join the Conversation

The AI transformation in embedded payments is far from complete. As AI technologies mature and new capabilities emerge, the most successful platforms will be those that prioritize thoughtful implementation over flashy features.What’s the biggest AI shift you see coming in payments? Tag us @Payabli to join the conversation and shape the future of intelligent payment infrastructure.

Curious how it’s already transforming the industry? Book a demo to see AI-powered payments in action.