It’s been a week since we announced our Series A led by QED Investors with participation from our existing investors TTV Capital, Fika Ventures, and Bling Capital. We’ve been floored by the outpouring of kindness and support from our partners, customers, team members and even competitors! While Will summed it up perfectly in his LinkedIn Post “We Haven’t Won Yet”, this is a big milestone for the company and we wanted to share some thoughts on this experience and what this means for the future of Payabli.

Otra Noche en Miami (Another Night in Miami)

When Will and I met in Miami nearly 15 years ago on a humid August night, before going out on the town, it would have been impossible to predict how our entrepreneurial journey would unfold. Who knew going salsa dancing at a Colombian club in downtown Miami would lead to a 15-year friendship and culminate in us founding Payabli. However, “connect the dots backwards” as Steve Jobs would say, and it all makes sense.

Will had already founded and was growing Revopay at the time. He was intrigued by my experience leading National Sales at Seamless and would constantly pepper me with sales strategy questions and would repeatedly tell me “Jo you have to start a business… you’re made to be an entrepreneur.” I knew from early on that if I did start a business I’d want to have Will as a partner. Our lives continued to dovetail with me heading back to LA for Business School at USC and Will moving back to LA to reunite with his Brother and Co-Founder Mike who was based in LA and co-leading Revo from the West Coast. My time at ServiceTitan was invaluable – not only did I get to help scale a category-leading vertical SaaS company, but it would ultimately lead to the inspiration to found Payabli. The success of ServiceTitan Payments illustrated for us that there was a tectonic shift of trillions of dollars of commerce migrating off of legacy ISOs and Processors and becoming embedded within vertical SaaS Platforms. Companies like Mindbody, Toast, and ServiceTitan were early to make payments a core part of their business model, but having to cobble together a fragmented payment infrastructure of legacy gateways and processors to execute a modern payments strategy was capital-intensive, time-consuming, and painful. There had to be a better way.

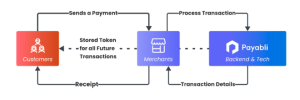

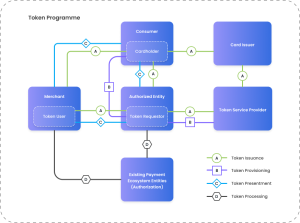

We founded Payabli to build what we believed the next generation of ServiceTitans’ would need. The Roofrs, BuildOps, and CurbWastes of the world were going to want a modern unified API and Infrastructure stack to quickly and easily embed and monetize payments. They’d want to have significant influence and control over not only the payment experience but also their Payments business. They needed tools to set pricing and customize boarding flows, understand how their merchant portfolio was growing and how they could maximize their payment margin, as well as transparency into merchant settlements and exceptions like returns and disputes. The platform would need to be “Developer First” with world-class documentation and dev tooling to give convenience and simplicity to the Developer Community. They’d need omni-channel capabilities to monetize their sub-merchant’s money acceptance. They’d also need diverse products to monetize their sub-merchants’ payment issuance to vendors, sub-contractors, and employees. They’d want a flexible platform and program that scaled with their business over time. They would want to work with a team that they could trust, that understood how important customer experience was, and that knows payments are the lifeblood of their business, making it critical to get them right. Helpful advisors that wouldn’t keep them in the dark on payments but constantly educate them on how the business worked and brought forth new ideas and innovations to enhance their integration over time. They’d need and want Payabli.

Trust the Process

We bootstrapped the business to $50K in MRR. The early customers that believed in us, we will forever be indebted to and are so grateful for them giving us a shot. We didn’t intend to raise Venture but we had some opportunities with large prospects that loved our technology and team but were skittish on taking a bet on a small unproven company. We figured if we had some institutional credibility behind us it would alleviate these objections and allow us to close bigger and bigger deals. We raised our Seed Round in mid-2022 led by Fika Ventures, with TTV Capital and Bling Capital as Co-Investors. We lucked out with our Seed Investors as each firm is composed of amazing people and bring their unique value to Payabli. As suspected, the institutional credibility helped earn the trust of new and larger customers, but also each of our investors rolled up their sleeves and were invaluable in sending us prospects, introducing us to new backend providers, and recruiting excellent talent. Over the last two years, it’s been a privilege working with and becoming friends with our amazing Seed Investors.

Coming off a successful 2023, and anticipating a big Q1, we began to prep for our Series A in January of this year. We were fortunate that we had been nurturing relationships with investors over the better part of a year and had garnered some significant interest from several firms. Given the positive experience we had with our Seed Investors we wanted to ensure our Series A investor would be equally as accretive and also have a positive impact on our culture.

We met Laura Bock at Money2020 and began to build a relationship with her and the QED Team. In our initial meeting, we could tell that Laura and QED were deeply curious about embedded payments and looking for the right company to back. Following the meeting, we were impressed by how much time they spent with us, really seeking to understand the overall Embedded Payments landscape and the unique nature of Payabli’s unified 3P offering. Each meeting was met with better and tougher questions as well as unique insights and points of view that QED had amassed given their research on the space. At the end of March, we let QED and a handful of other funds know we were going to raise and that kicked off a whirlwind fundraising process that would culminate in multiple terms sheets from incredible investors including QED within two weeks.

We recognize it’s a very difficult time to be raising capital and we are in a very fortunate position. We are extremely grateful to all of the investors who got to know us throughout this process and those who believed in Payabli enough to ask to invest. We ultimately chose to go with QED for the following reasons:

- Reputation in Fintech: QED invests exclusively in Fintech and has a stellar reputation and global footprint. Nigel and Frank were Fintech pioneers having built Capital One into the powerhouse it is today, and have backed multiple category-leading businesses like Credit Karma, Nubank, and Remitly.

- Partner Fit: Laura stayed engaged with us for many months and as we got to meet her and more of the team including Shruti we observed them “getting it” more and more. They asked better / tougher questions, brought us new intel, and gave us helpful feedback on our positioning and strategy. They also saw the value we bring in unifying the 3Ps and appeared to be all in on our thesis. They remained steadfast in their conviction for investing in Payabli and every month nudge us to remind us of their interest. The fundraising process felt like a glimpse of how it would be to work with Laura and QED, they were engaged and thoughtful, as well as easy to work with and fair throughout the negotiation process.

- Founder Love: We spoke with six or seven references from QED and also did quite a bit of back channeling. Time and again the Founders were extremely complimentary of QED and Laura specifically. One founder told us flat out “ You’d be crazy not to go with QED”. Founder Love was a big determinant and hearing some of our peers who were building extraordinary companies sing QEDs praises left a big impression on us.

Thank you to the entire QED Team for believing in Payabli and joining us on this exciting new chapter in our journey.

So, What’s Next?…

When we raised this round we still had about 1.5 years of runway left and had doubled revenue in a quarter. We decided to raise opportunistically to further accelerate growth, build more, and enhance our product. Here’s how we intend to use the funds.

We’re dreaming big at Payabli. We like to say we’re building the AWS of Payments where whatever payment experience a developer wants to build Payabli has myriad solutions to offer them. We’ve already built a lot of product, however, we want to continue to innovate and bring to market cutting-edge new products while maintaining reliability and scalability. We are investing heavily in more engineers and engineering leadership to ensure we’re consistently shipping new and better product. We are excited to unveil numerous new features and products coming out in the second half of 2024.

The funds will help accelerate further growth. Payabli has grown to nearly 8 figures in revenue and over a billion dollars activated processing volume off of pure cold outbound prospecting and referrals. We’re just starting to get our marketing motion in place and will be investing heavily in new marketing channels as well as further building out our small but mighty sales team. As our Product Owner Adrian Rosario likes to say “Payabli’s been all steak, no sizzle.” Well, we’re bringing the sizzle to Payabli this year.

While you’ll see more active marketing and more prominent brand awareness, we won’t turn our back on what got us here, providing great technology coupled with white-glove support and trusted advisory to our partners. We’re hiring additional Success and Operations team members to support our growing list of Partners and Sub-Merchants. We’re also bringing on more Solutions Engineers, Technical Writing, and Developer Evangelists to help our Partners integrate with us more quickly and easily. We’ve historically focused a lot on condensing the Sales and Integration Processes. We believe that a lot of the industry has neglected a critical element which is helping Partners ramp their volume by driving customer adoption once they are live. We will be investing heavily in partner marketing and enablement to help our partners not only integrate with us, but maximize their customer adoption and drive maximal revenue.

A BIG Thank You!

We’re thrilled to be in this privileged position of having raised our Series A round of funding. We are so appreciative of everyone who has helped us get to this stage. From our earliest to our newest Software partners thank you for entrusting us with such a critical part of your business and selecting us to be your partner. To our investors QED, TTV, Fika, and Bling thank you for your support, guidance, and friendship, we couldn’t imagine not having you in our corner. To our team members from the OGs that started when we were nothing more than a dream to the new team members choosing to bet their careers on Payabli, we love you guys and thank you for being in the trenches with us every day. We haven’t won anything yet, but we intend to leverage this capital to propel us to become a category-leading Payments Infrastructure company and continue to empower the entrepreneurial economy.

Best,

Jo and Will