Early on in the journey of founding Payabli, we were Centavo Inc., we had no product and were selling legacy processors APIs trying to prove we could sell SaaS companies on monetizing their Payment Processing. Looking for any way that we could maximize our value to our prospective Software Partners we stumbled on this fascinating concept called Interchange Optimization.

If you’re somewhat familiar with Payments economics you’re likely familiar with Interchange; the wholesale costs that Card Issuers receive on each transaction processed. Interchange is typically the bulk of the charges that Merchants end up paying when a credit card transaction is processed. We learned that by passing additional information called Level 2 and Level 3 addenda data you could reduce these interchange costs on B2B Transaction by between 30 basis points (.30%) and 110 Basis Points (1.10%). When I heard this suddenly the raucous Hip-Hop anthem “I’m on a New Level” by Rapper’s ASAP Ferg and Future started playing in my head; this was going to be a game changer for our partners.

Interchange Optimization in Practice

The reason I was so stoked about L2 and L3 processing is that it essentially opened up two benefits for us and our Software platforms:

1. Higher Margins: Most Software partners are able to charge a Flat Rate for their processing. By optimizing interchange rates you could reduce your cost basis significantly and return much higher margins to the Software Partner. Let’s walk through an example. We work with a Software Platform that services a lot of Residential and Commercial HVAC Companies. They price their Payment Processing at 2.90% and $.30, if they take a Non-Qualified Business transaction, Interchange alone is 3.15% and $.20. Tack on Network Fees and the Software platform is in the whole more than 40 basis points (.4%). However, if we pass level 2 data at the time of transaction the interchange magically reduces to 1.9% and $.10, creating roughly 80 basis points (.8% of margin) on that transaction.

2. Aggressive Pricing while Preserving Margin: In most cases, Software Platforms can command a higher Flat Rate for the value of an integrated offering. However, there are certain strategic clients that will be hyper price sensitive and will command an interchange plus pricing model. In these instances, we’ve found that as long as there’s some commercial card mix, we can use L2 / L3 processing to charge a higher markup above Interchange while still matching or coming in lower than their existing processors’ effective rate. For example one of our Private Equity Partners introduced us to an Enterprise Merchant that distributed industrial equipment and nearly all of their card mix was commercial. They had a ridiculously low rate with their existing processor, however, we were still able to unlock over $200K in annual savings just by optimizing their interchange.

The Skinny on Qualifying for Level 2 & 3:

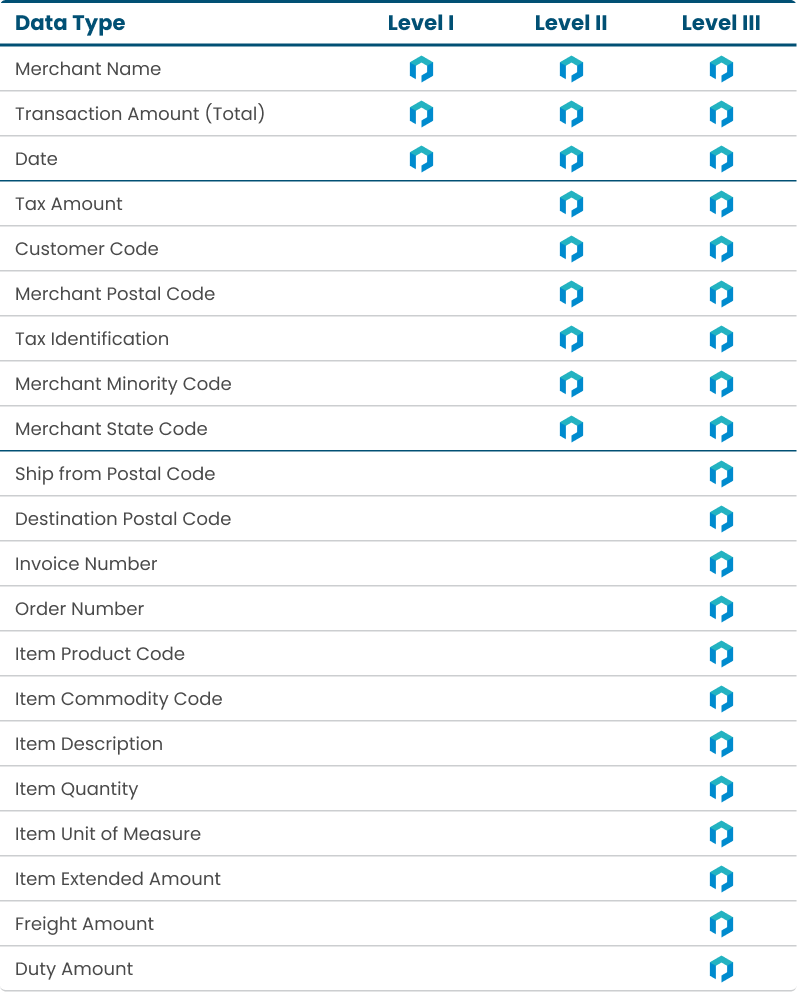

For SaaS platforms, the key is to collect and transmit the required addenda data to qualify for these optimized rates. This not only offers a route to reduced interchange but can be helpful in reducing chargebacks. Below are the types of addenda Data needed for L2 and L3 Processing:

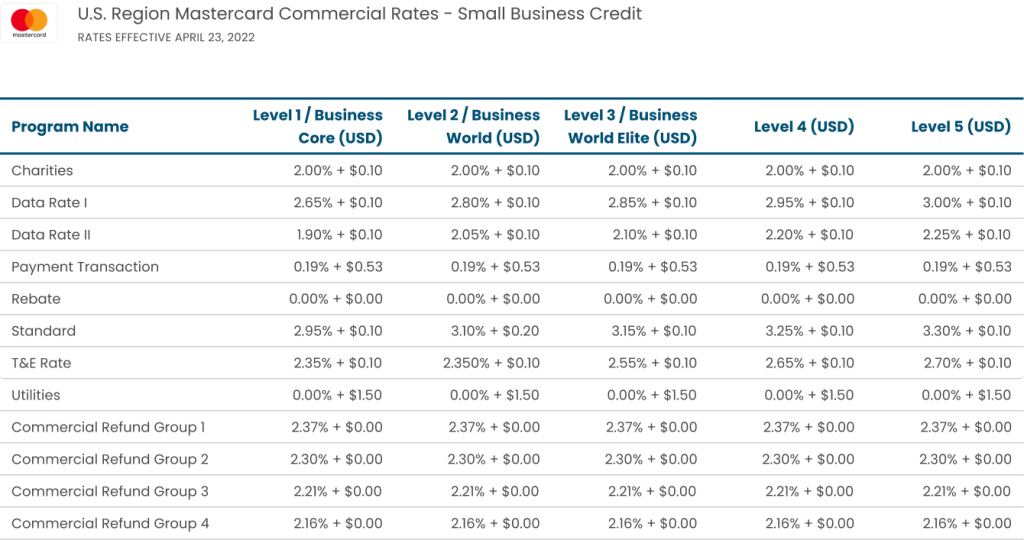

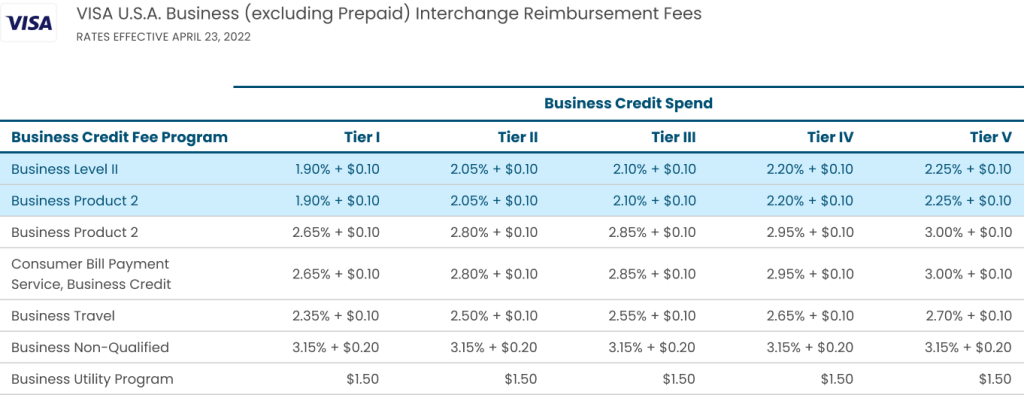

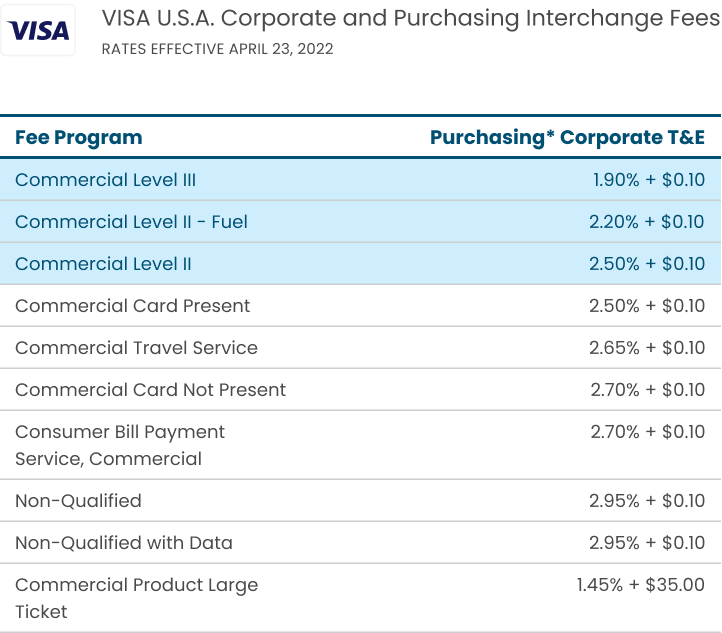

below are Interchange categories that qualify for L2 and L3 processing and their corresponding rates. If you’re curious the different Tiers (Visa) or Levels (MC) correspond to the amount of annual spend performed by that customer.

Now you can send all the addenda data you want, but unless your Payment provider is certified to transmit Level 2 and Level 3 data, you’ll won’t reap these benefits. If your platform’s merchants have any B2B commercial mix you’ll want to make sure your Payments infrastructure offers this capability.

The Wrap Up

At Payabli we often say we’re building the AWS for Payments. Our vision is that whatever Payments use-case a Software Platform has they can come to Payabli for best-in-class Payments technology and leverage as much or as little of our offering to suit their needs. Level 2 and Level 3 processing is just one example of the diverse solutions Payabli offers SaaS Platforms looking to make Payments a Core Part of their business model.

By qualifying for Level 2 and Level 3 processing, Vertical SaaS platforms can see significant reductions in interchange fees. These savings translate directly into better margins for your SaaS platform, making the effort in collecting and transmitting the required data well worth it.

Conclusion For Vertical SaaS platforms, transitioning to Level 2 and Level 3 processing isn’t just a technical adjustment but a strategic one. By ensuring the capture and transmission of the required addenda data, platforms can drastically reduce transaction costs and simultaneously offer greater value to their merchant base. It’s time to leverage these benefits and get ahead in the competitive SaaS landscape!