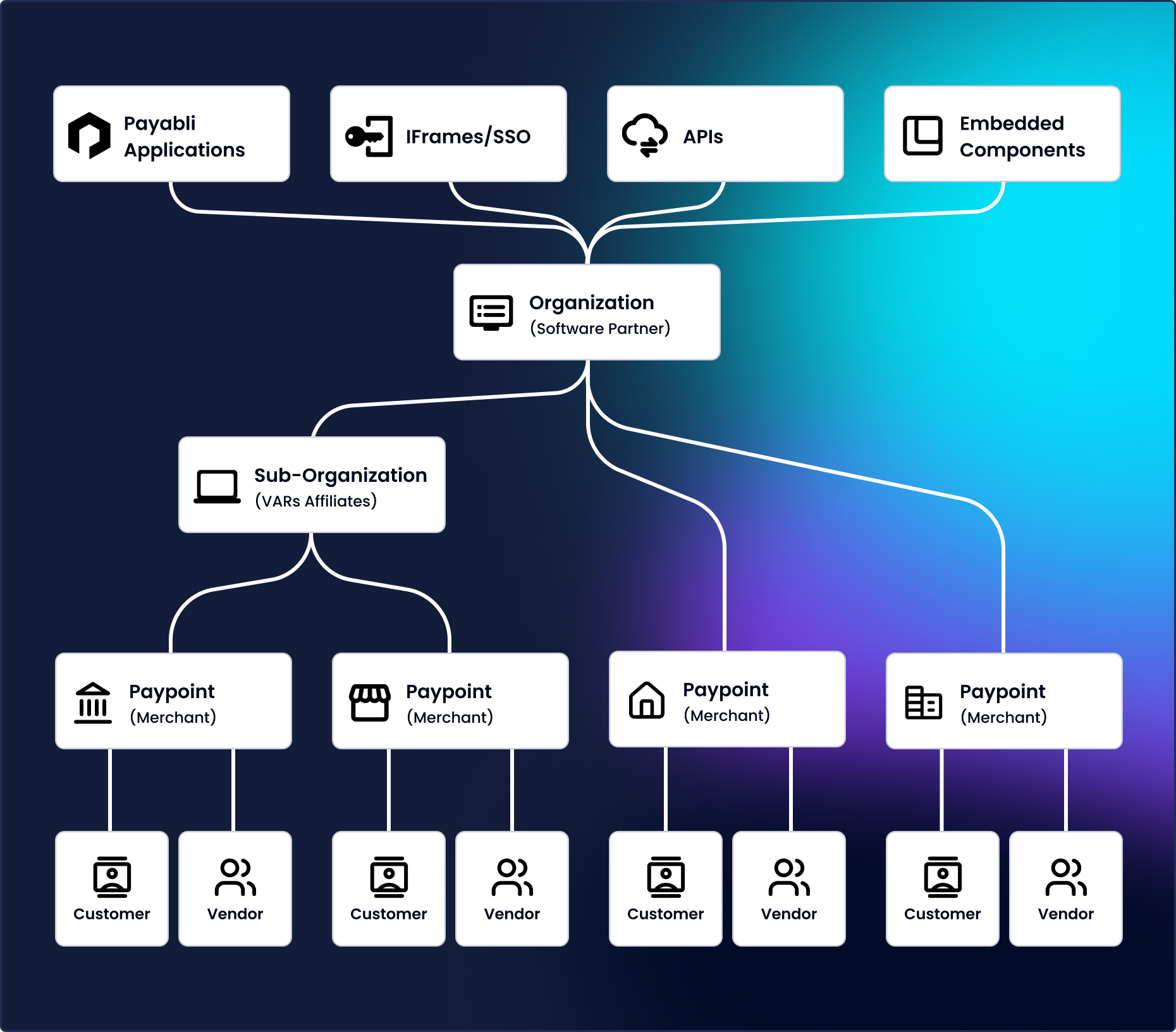

PCI DSS 4.0 compliance

Achieving and maintaining PCI DSS compliance is critical for businesses handling sensitive card data. Payabli adheres to the rigorous standards of PCI DSS 4.0, offering secure solutions designed to protect cardholder data and prevent unauthorized access.