Launch and scale Pay Outs as a service

Equip your customers to pay vendors, sub-contractors, employees and other recipients, efficiently and securely while delivering a new monetization opportunity for your platform.

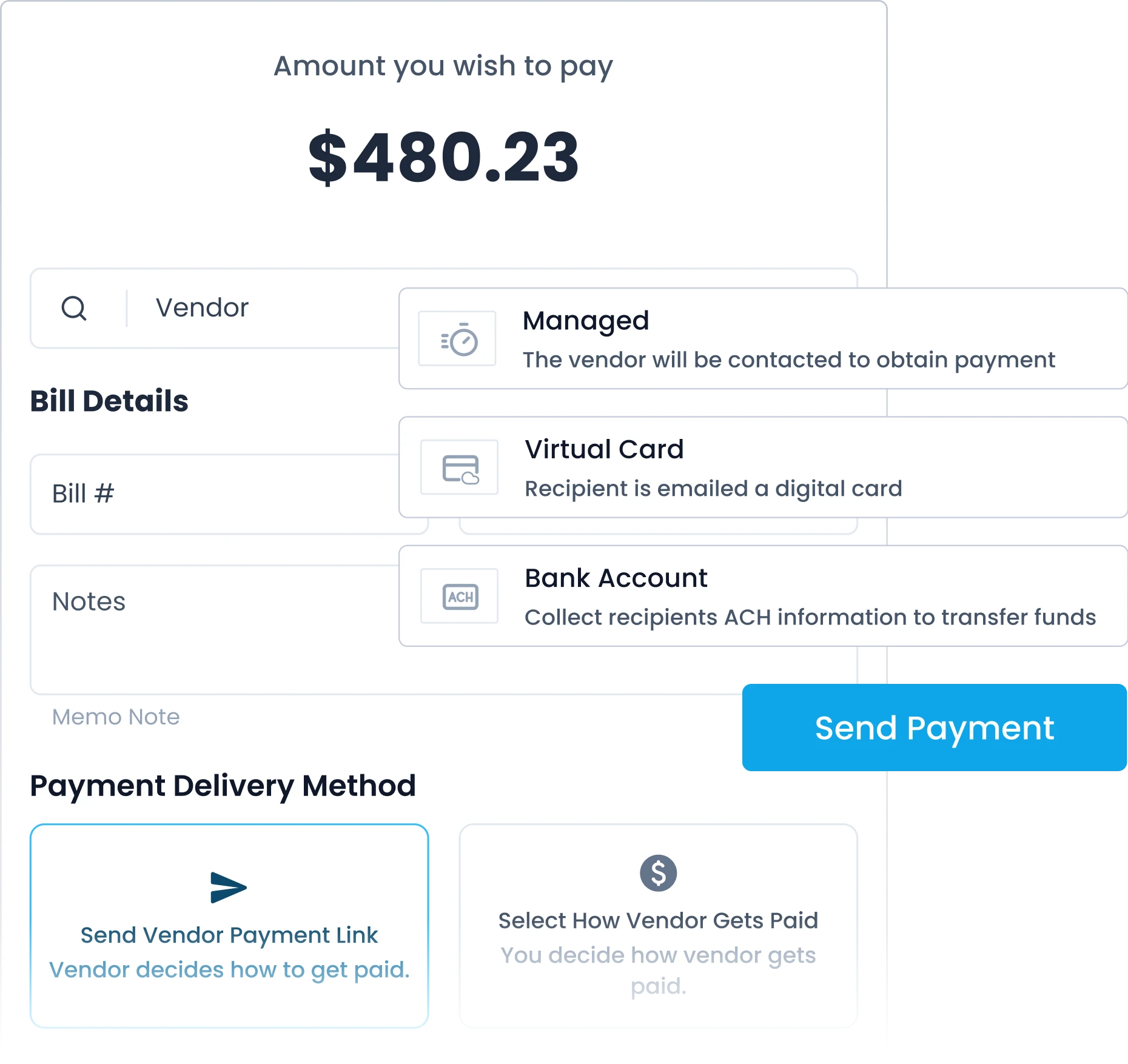

Create user-friendly, robust embedded payables experiences into your products. Payabli gives you full control over the payout experience—dictate payment modalities or allow recipients to select the method of their choice, unlocking lucrative revenue across multiple payment modalities.

Equip your customers to pay vendors, sub-contractors, employees and other recipients, efficiently and securely while delivering a new monetization opportunity for your platform.

Developer Friendly API to help you quickly and easily integrate and begin monetizing payables.

Customizable Java-Script components to help you quickly and easily integrate while reducing PCI Scope.

Brand and configure a comprehensive payments platform to suit your Bill Pay needs.

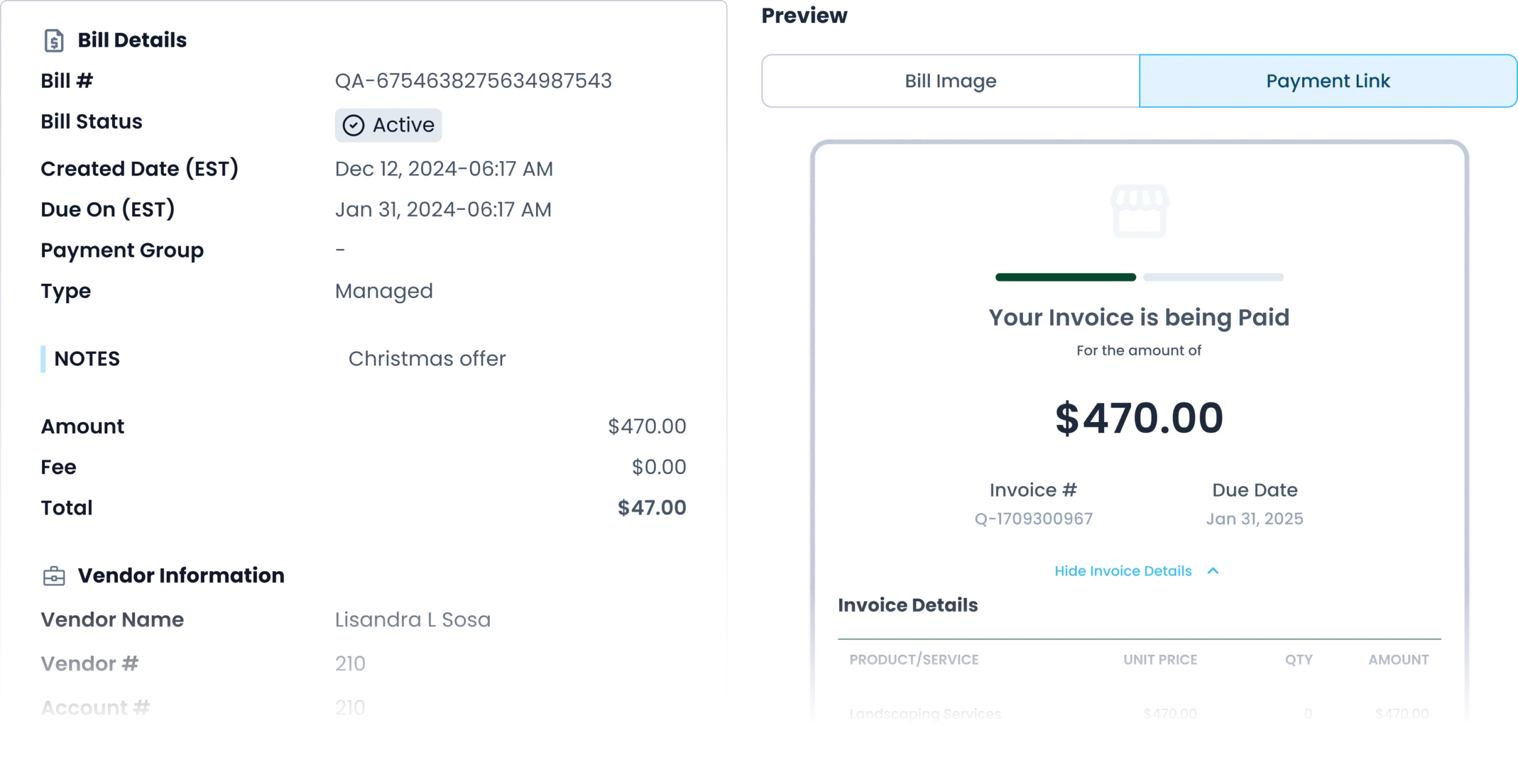

Leverage Payabli’s Managed Payables program to streamline vendor payment execution. Transmit large accounts payables files via API or SFTP, automatically match payments with previously enrolled vendors, and activate vendor enablement to pay every single bill securely and efficiently.

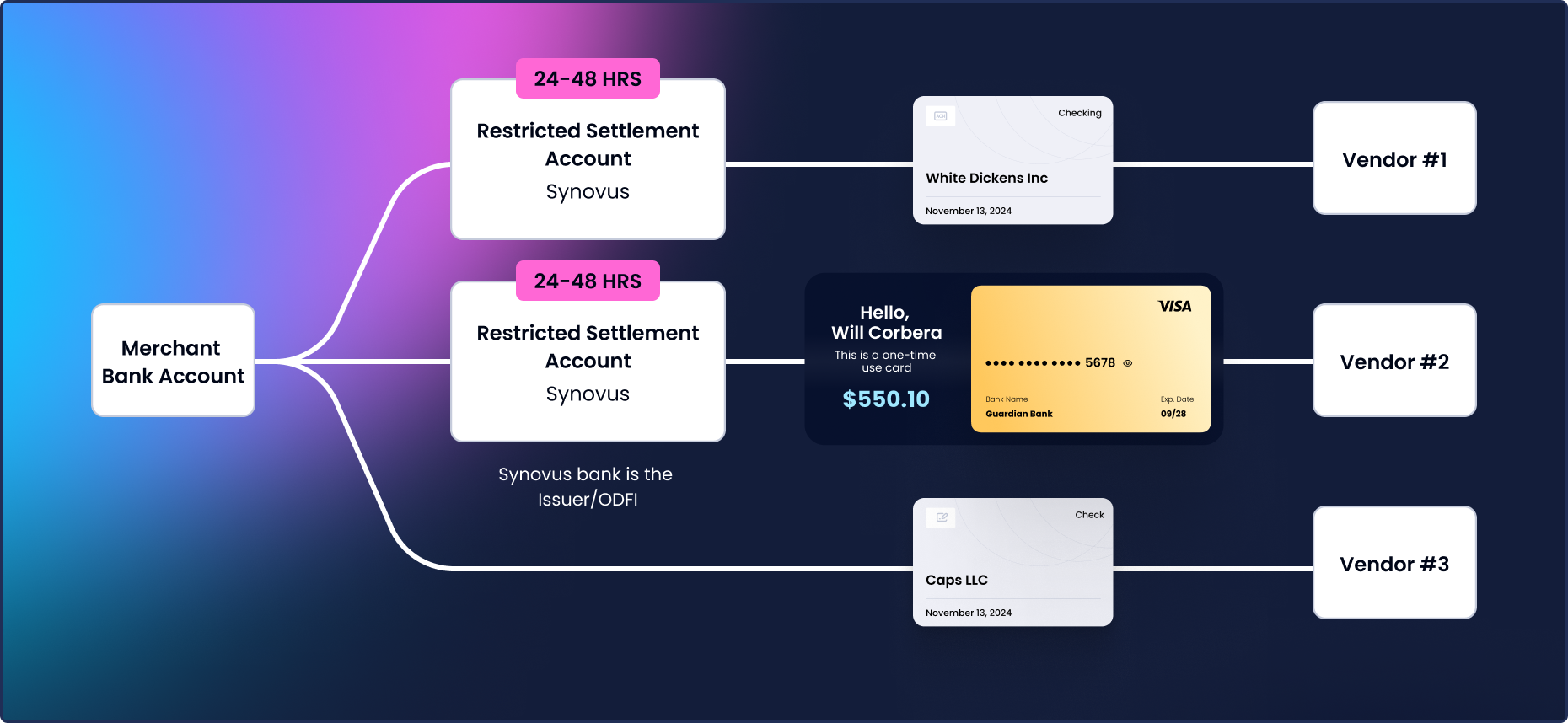

Pay 100% of bills submitted by offering multiple modalities: vCard, ACH, and Physical Check. RTP, Push-to-Card, Digital Check and Wires (coming soon).

Drive superior virtual card adoption in turn earning higher rebates through real-time Vendor Enablement

Full exception management support for unprocessed payments, payment method change requests and disputes.

Webhooks and notifications to track the entire payment lifecycle

Custom approval workflows to combat fraud and enforce compliance

OCR engine to scan and present bills in your user experience

Dynamically issue payout links or create custom payout journeys. Dictate payment modalities or allow recipients to select their preferred modality.

Virtual card

ACH direct deposit

Physical check

Push to card (coming soon)

Fed Now/RTP (coming soon)

Digital check (coming soon)

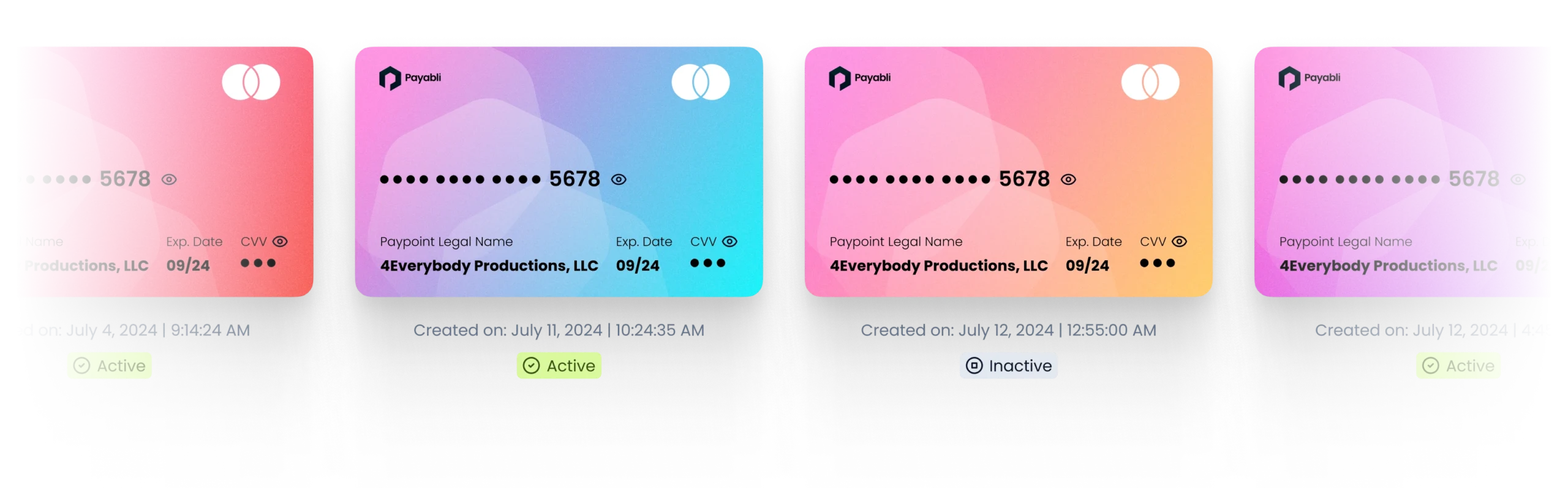

Embed and deploy digital and physical corporate card issuance for incidentals and expense reimbursement. Payabli makes it easy to develop a best-in-class, vertical-specific purchasing card solution.

Optimize efficiency, reduce the cost of internal processing, simplify reimbursement, and minimize the risk of fraud and overspending.

Add custom rules for spend limits, MCC restrictions, funds routing, and more for complete control over your program.

Increase flexibility and visibility with multiple forms of payment, prefunded + credit models, and a mobile-friendly experience with real-time alerts.

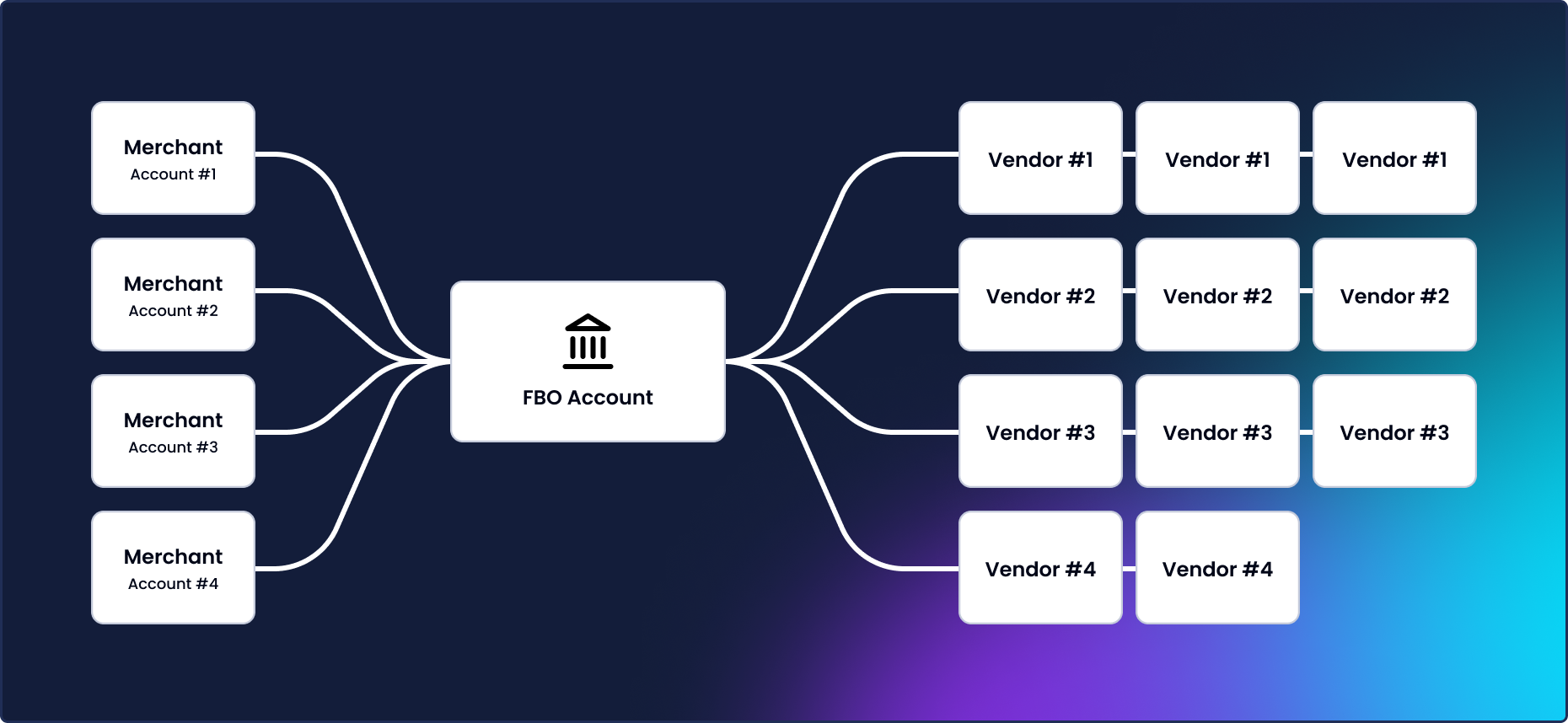

Track remaining balances, error handling, and reconciliations across a complex network of payment recipients and accounts. Payabli provides detailed audit logs, simplifying reporting and compliance to help you assess the overall health of your payables operations.

Leverage different money movement rails to create elegant verticalized solutions.

Route funds through a Custodial FBO Account prior to issuing payouts.

Leverage an innovative credit-debit offset model to issue funds immediately.

"With Payabli’s simple APIs and Pay Out partnership, we launched a payment solution for our end clients in record time, enabling us to facilitate millions of dollars in payments each month. Bringing an Accounts Payable product online has transformed our business—expanding into new markets, evolving into a fintech leader, and achieving more payment volume in July 2024 than all of 2023 combined."

CEO and Founder, EdStruments

Remove the burden of payout compliance from your in-house team. Payabli’s built-in due diligence workflows protect you from fraud and keep you compliant with PCI, SOC-2, and other regulatory standards.

Maintain control over your portfolio and meet your KYC/B, CIP, PCI and AML requirements with our underwriting and monitoring tools.

Protect your merchants from fraud with a combination of powerful machine-learning models and simple heuristic rules to prevent suspicious transactions.

Have access to a network of best in class underwriting and risk vendors that fit your portfolio.

Whether your customers are getting paid or sending payments, we help you optimize and monetize your payments strategy. Payabi removes the heavy lifting with proven payment experience, a robust set of products, and white glove advisory services.