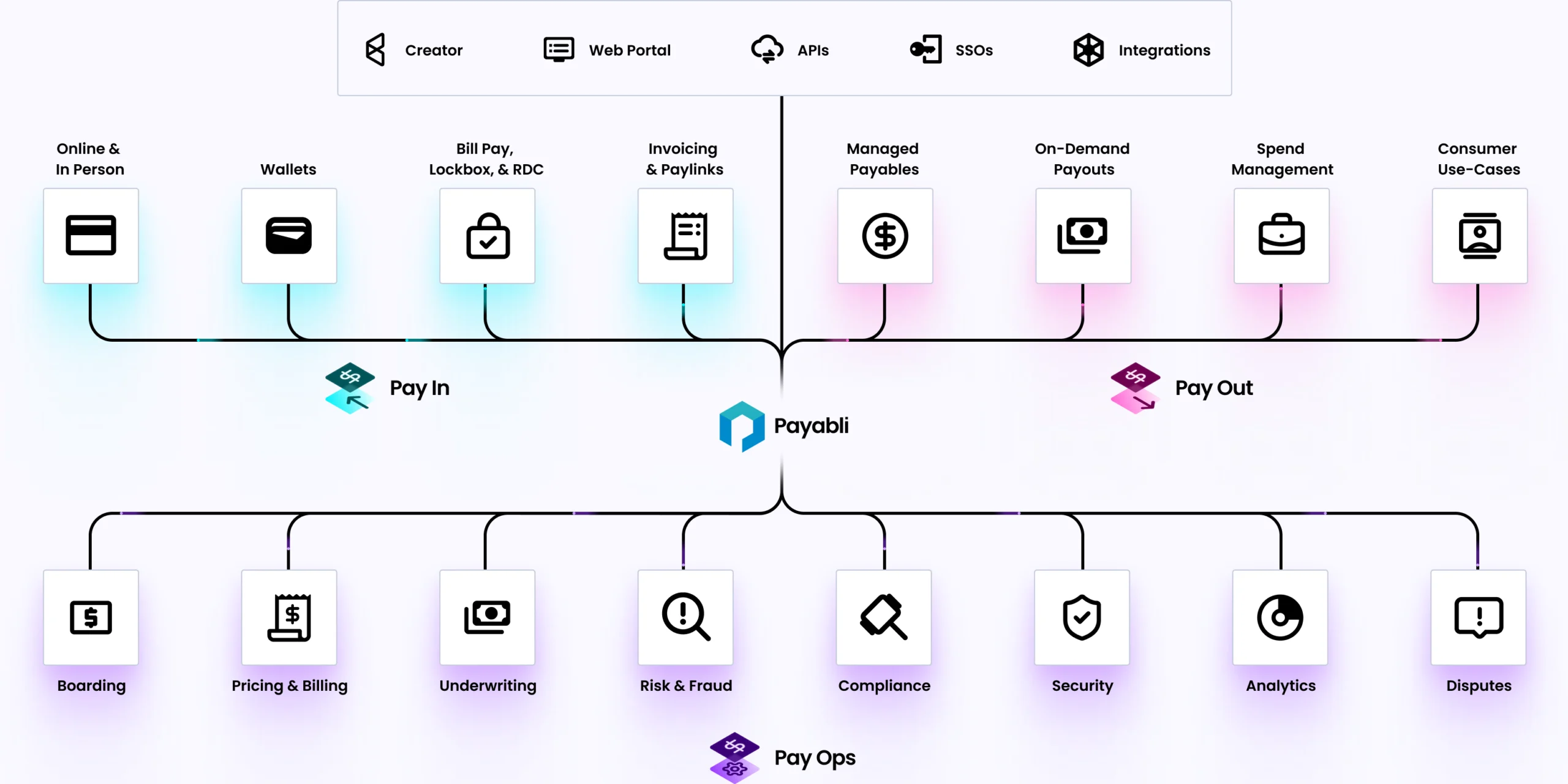

Pay In

Easily accept payments, onboard merchants, and enable revenue streams seamlessly

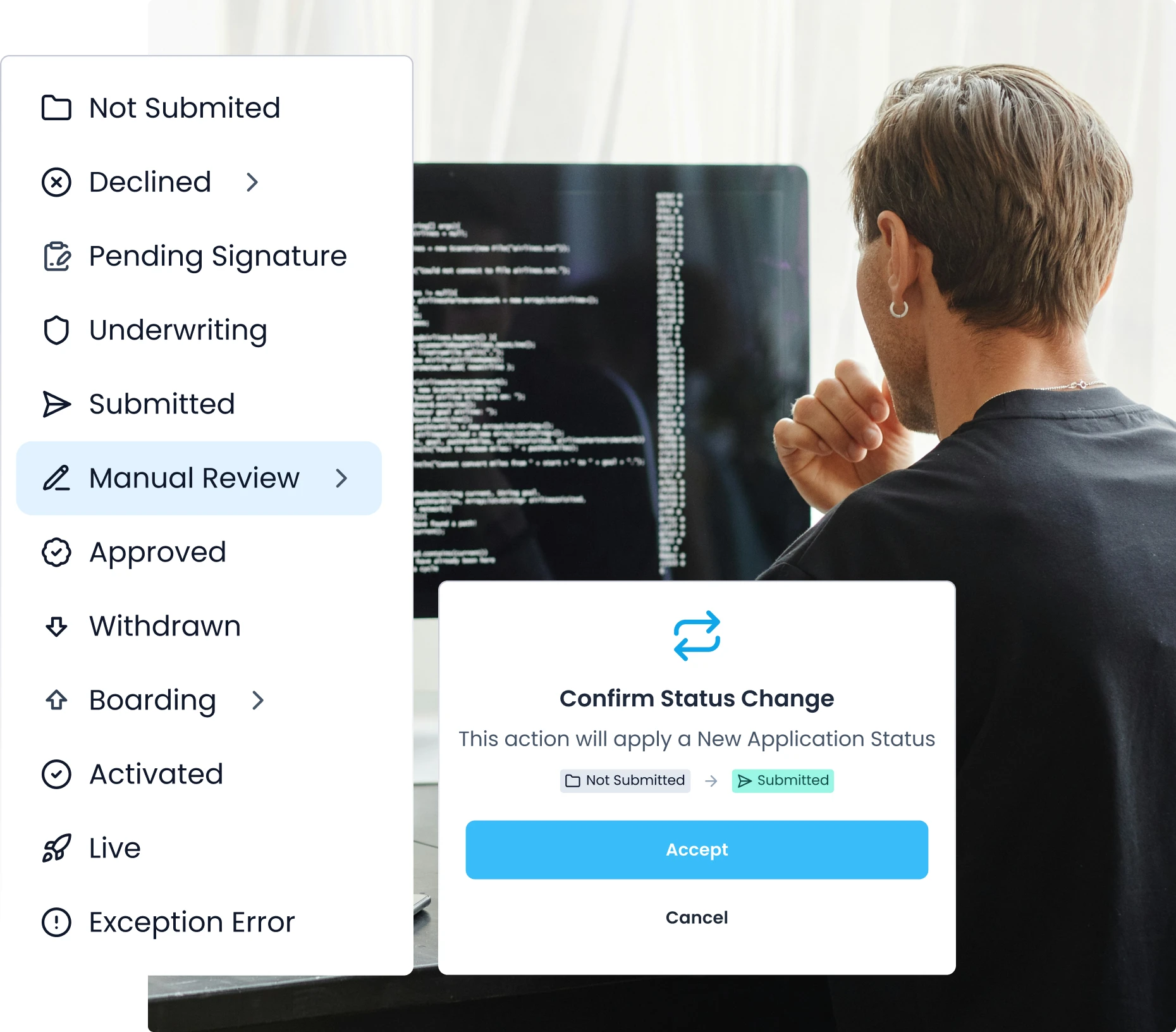

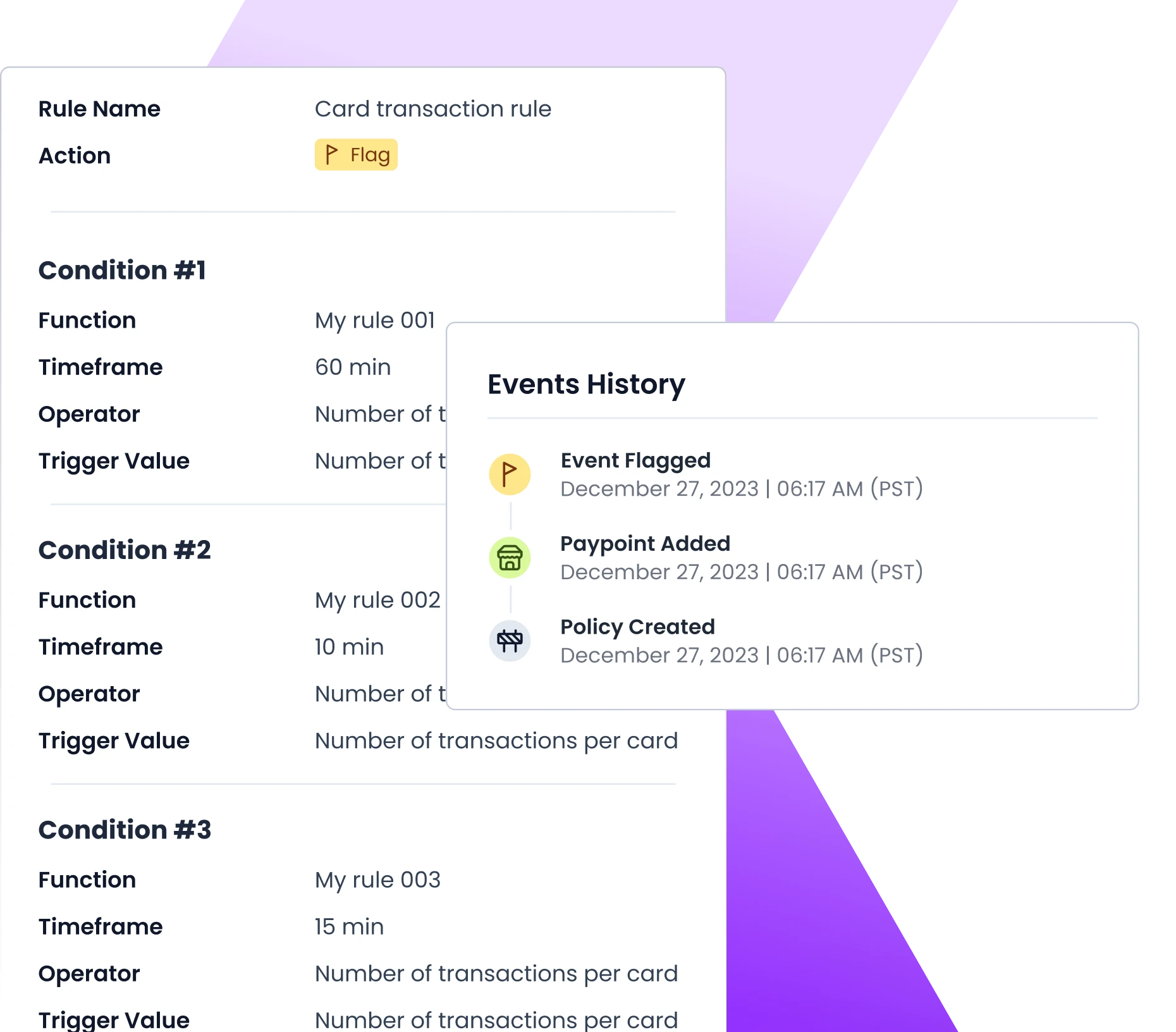

Pay Ops

Streamline payment operations, reduce inefficiencies, and scale with advanced reporting

Pay Out

Create customizable payables experiences, offering flexible payment options for recipients

Creator

Embed powerful, code-free payments features to monetize and scale effortlessly